Table of Contents:-

- Meaning of Global Services

- Growth of Global Services Markets

- Stages of Global Services

- Factors Influencing Global Services

Meaning of Global Services

According to Radulovich, “Global services are deeds, performances, efforts conflicted across national boundaries in critical contact with foreign cultures”.

However, in some cases, firms will become internationally active before any extension of national coverage. This is particularly the case for those business service firms located in capital cities or other major areas of agglomeration. In such locations, firms will likely have internationally oriented clients early in their development, encouraging their international rather than inter-regional expansion.

Growth of Global Services Markets

The service industries are significant to the developed economies regarding output, jobs, and trade balances. Increasing internationalisation of services is likely to be encouraged by slow but real progress towards an international agreement to reduce service trade barriers in the current Uruguay Round of GATT. Demand growth has recently begun to flatten out as market penetration, industry concentration and rationalisation take their course, both nationally and internationally. This process is already well-advanced in retailing, airlines and financial services, and has progressed some way in professional service firms and advertising and media agencies. Expansion into world markets has followed domestic industry restructuring.

Three factors underpin the growth in services:

- Increased Demand for Firms Services by Both Households

- Standardisation of Service Delivery Processes

- Separation of Service Suppliers

1) Increased Demand for Firms Services by Both Households

Demand for new types and service configurations arises from the advanced economies’ changed socio-demographic structure, such as dual-income families, single-person households, affluent older consumers, and financially more sophisticated consumers. Greater corporate consumption of services arises from more specialization, sophistication, and internationalization, as in corporate business travel expenditure management and executive recruitment examples.

2) Standardisation of Service Delivery Processes

Growing capital intensity and rising productivity of specialist service companies (both mostly IT-related) make internal service provision increasingly inefficient. The ability of large service firms to standardize and replicate facilities’ methodology and procedures across locations exacerbates this. Specialisation and standardisation lead to high-quality provision at a lower cost to the client company or customer, whether in car exhaust and tyre centres or consultancy packages for executives.

3) Separation of Service Suppliers

Growth has also come from more specialist service suppliers replacing service provision previously carried out in-house. This is called “externalisation” or “de-integration”.

Related Articles:

- nature of business meaning

- nature of international business

- scope of international marketing

- determinants of economic development

- nature of capital budgeting

- nature of international marketing

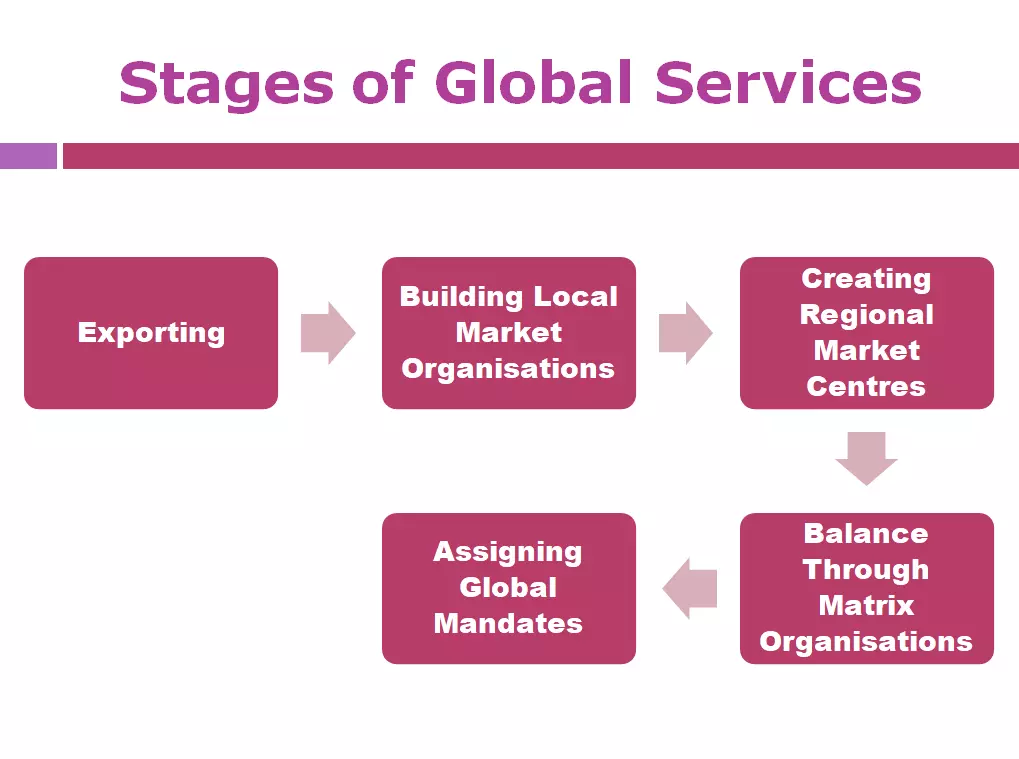

Stages of Global Services

The stages in globalisation usually followed by service companies are as follows:

- Exporting

- Building Local Market Organisations

- Creating Regional Market Centres

- Balance Through Matrix Organisations

- Assigning Global Mandates

Stage 1: Exporting

When the domestic market becomes saturated or companies identify demand in foreign markets, they start exporting their products or services. The export department is still a function of the domestic company, normally reports to the company, and follows company procedures and strategies. Often, companies first begin to receive inquiries from foreign companies about their products. At that point, the company establishes an export person or department to handle and address these inquiries.

Stage 2: Building Local Market Organisations

When the demand for a service or product increases and an overseas office is needed to ease administrative procedures, investigate new markets, or refine old markets, a company normally establishes an office in a foreign country. Usually, this office is under the control of headquarters and acts according to home office directions.

Stage 3: Creating Regional Market Centres

Regional market centres act as filters between company headquarters and various country organisations. Regional market centres coordinate the marketing function of the branches so that they remain in line with corporate objectives. Normally, regional market centres organize themselves along geographic lines; however, they can also arrange themselves along product groups or similar target markets.

Stage 4: Balance Through Matrix Organisations

The matrix organisation is the most complex and sophisticated structure. It requires a firm to be fully competent in the following:

- Geographic knowledge,

- Product knowledge

- Functional aspects, such as finance, production, and marketing, and

- Customer and industry knowledge.

Instead of focusing on one area – geographic or product organisation – the matrix organisation incorporates both and each operates as a profit centre. Matrix organisations allow low levels to have substantial authority however, they require an open and flexible corporate culture and company orientation for successful implementation.

Stage 5: Assigning Global Mandates

Fully advanced global companies with complete integration have begun to establish Strategic Business Units (SBUS). An SBU acts as a separate business and contains a group of products or technologies directed at a specific target market. SBUs are part of a formal structure but act primarily to determine strategies.

Factors Influencing Global Services

The company’s internationalising process is affected by both company-related internal factors and external factors out of the company’s control are discussed as follows:

- Internal Factors

- Line of Industry

- Size of the Firm

- Product-Related Factors

- Planning-Related Factors

- External Factors

- Home Country Factors

- Host Country Market Structure

- Trade Barriers

- Political Stability of the Host Country

- Cultural Distance

- Marketing Infrastructure of the Host Country

1) Internal Factors

Firm-related factors form one group of factors affecting decision making that confess foreign market penetration. A company influences these factors. Thus they indicate the company’s ability to respond to problems or opportunities related to the foreign market. Different internal factors affect the internationalisation process.

i) Line of Industry

The line of industry a company operates in seems to have an impact on the company’s internationalisation. Enterprises belonging to technical, fast-growing and comparatively new industries have to a great extent extended their business to foreign markets by using different penetration modes.

ii) Size of the Firm

Different operations demand varying levels of financial and other resources. That makes logical the assumption that the size of the firm correlates with the use of different operation forms demanding large resources. The general hypothesis is that the larger the company the larger the resources it has. On that basis, it is assumed that large companies have better possibilities than smaller ones to exploit direct investment techniques when penetrating foreign markets. Large firms are better able to handle the risk of investment to explore potential opportunities.

iii) Product-Related Factors

The term “product” refers to both services and tangible goods unless otherwise stated. The company’s product and its characteristics and related factors, which may affect operations abroad are discussed as well. When a company takes its product into markets abroad it may have to adapt the product to the requirements, customs, tastes and needs of target country customers. This adaptation is easier to deal with when having closeness to markets in terms of own operations and investments in the target country.

iv) Planning-Related Factors

The plans that a company have for the future determine its operational choices. By showing the main lines of future actions, these factors are the basis for the total future activities. The mission of the firm expresses the customer needs that the company is going to satisfy with services or products. A clear mission putting great emphasis on operating abroad, i.e., on satisfying the needs of foreign customers, allows considering operating abroad.

(2) External Factors

External factors influence on service company’s entry mode choice through the delineation of levels of control, resource commitment, degree of risk and level of return associated with each mode of operation.

External factors can typically be classified into the following categories:

i) Home Country Factors

Home market characteristics, especially the size and composition of domestic demand, maybe a remarkable factor leading to competitive advantage. Companies with a large-sized and also demanding and sophisticated home market are usually innovative and competitive. Experience in competing in a home market like that offers companies chances to exploit economies of scale halo effect in the eyes of foreign buyers, know-how needed in competing in the market, talent to satisfy the most demanding buyers, and good self-confidence in general.

ii) Host Country Market Structure

Competitive pressures on the market force companies to perform effectively at low cost and to deal with each other in a fair, honest and good faith way to avoid being replaced. In non-competitive industries, a new entrant’s degree of control has a negative relation to the company’s international experience. Whenever the supplier market is competitive, companies are advised to avoid integration because in this way the firm may gain both a high return and low risk.

iii) Trade Barriers

When planning to penetrate a new market abroad, one should evaluate trade barriers as an external factor. Barriers may turn out to be a critical factor in case they are a source of prohibitive costs or difficulties. Barriers to international services are whether direct tariffs or non-direct non-tariffs. Compared to non-tariff barriers tariff barriers are relatively straightforward and transparent. Non-tariff barriers can be either entry restraints, such as requirements for local ownership and labour restrictions, or operational barriers including discriminatory taxation, currency controls, local investment requirements and others.

iv) Political Stability of the Host Country

The volatility of the company’s environment creates external uncertainty. This uncertainty can be referred to as different things but typically it translates into country risk, taking many forms such as political instability, economic fluctuations, currency changes, etc. When the setting is volatile higher control entry modes are not expected to be more efficient than lower control modes (e.g., licences and other contractual methods). According to transaction cost analysis, entrants in uncertain markets are more easily accepting low-control modes of entry.

v) Cultural Distance

Cultural factors are likely to have a greater impact on the internationalisation patterns of service companies. It includes all the customs, language, material artefacts, and shared systems of attitude and feelings. As different cultures have their own different meanings and expressions interactions with people from different cultures differ remarkably. Usually, companies having little foreign market experience prefer entering markets at a short cultural distance. On the other hand, born-global companies may start internationalising with countries at a large cultural distance from the home market.

vi) Marketing Infrastructure of the Host Country

The more adequate the commercial and financial infrastructure of the host country market, the better the firm can focus on its marketing task. For example, this infrastructure refers to advertisement agencies, marketing research companies, and credit and banking facilities. In general, a poor marketing structure is more likely to favour entry modes representing a greater distance from the market.