Table of Contents:-

- Meaning of Capital Budgeting

- Definition of Capital Budgeting

- Capital Budgeting Meaning

- Nature of Capital Budgeting

- Components of Capital Budgeting

- Process of Capital Budgeting

Meaning of Capital Budgeting

An organization must invest periodically to align with its business objectives, whether acquiring new fixed assets or replacing existing ones. The business enterprise can make these investments using its funds or borrowed funds. The management must make a critical decision in both scenarios regarding the selection of the best investment proposals from the available options. Before finalizing decisions of this kind, we meticulously weigh the advantages and disadvantages of each proposal. Factors such as the needed capital investment, anticipated future returns, and other pertinent considerations undergo a rigorous evaluation. The term commonly used to describe the complete process of ‘Investment Decisions’ is Capital Budgeting or Capital Expenditure Decision.

In any proposal under consideration of Capital Budgeting, the capital outlay (outflow of funds) is generally instant, whereas the benefits generally start pouring in after a long gap of time (generally after one year).

Definition of Capital Budgeting

An Investment decision about long-term assets to generate revenue for the business entity (and not for sale such as land, building, machinery, furniture, etc.) is termed Capital budgeting.

It involves long-term planning and monitoring of capital expenditure, besides examining each proposal in a very logical and scientific manner to finalise the best proposal.

Capital expenditure varies from revenue expenditure because its benefits generally manifest after a considerable gestation period, often extending beyond one year. Revenue expenditure involves the generation and consumption of benefits in the same fiscal year.

Several authors have defined ‘Capital Budgeting’ in various ways. Some of them are as follows:

According to Charles T. Horngren, “Capital budgeting is long-term planning for making and financing proposed capital outlays”.

According to Robert N. Anthony, “The capital budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets together with the estimated cost of each product”.

According to Milton H. Spencer, “Capital budgeting involves the planning of expenditures for assets, the returns from which will be realized in the future period”.

Capital Budgeting Meaning

Capital Budgeting is the process used by businesses to evaluate the major project investments such as new plants and equipment. The process of capital budgeting involves cash inflows and outflows to analyse whether the expected return meets a set benchmark or not.

The methods used for capital budgeting enable companies to maximise their return on investment and achieve financial objectives. Some popularly used methods for capital budgeting are discounted cash flow, throughput analysis and payback analysis.

Nature of Capital Budgeting

The process of capital budgeting exhibits the following nature:

1) Proposed investments, though made in the present, yield returns that extend over several years into the future.

2) When performing ‘Capital Budgeting’ for an investment proposal, we assess expenditure and projected return in terms of cash flow, which includes cash outflows and inflows.

3) Only long-term investment suggestions undergo evaluation using the capital budgeting approach.

4) Maximisation of the value of the business organisation should be the sole criterion for selecting or dropping an investment proposal.

5) The business may make investment decisions on a single project proposal or for two or more project proposals that are mutually exclusive simultaneously.

Related Articles:

- nature of business meaning

- nature of international business

- scope of international marketing

- determinants of economic development

- nature of international marketing

Components of Capital Budgeting

The process of Capital Budgeting analysis involves the following essential components:

1) Cut-Off Rate

It is essential to decide in advance the minimum level of return (rate of return) expected from the investment in the proposed project. Normally, the ‘Marginal Cost of Capital’ of a company is equivalent to the Cut-Off Rate.

2) Cash Outflows

Careful estimation of the investment required for a project, at its initiation and at different time intervals, is essential. In addition to the expenses associated with acquiring the essential assets for the project. The project implementation incurs additional miscellaneous expenses such as installation costs, transportation charges, and working capital requirements. It is important to estimate these expenses carefully, as they hold equal importance in the overall project budget.

3) Cash Inflows

The viability of a project depends significantly on the consistent flow of cash inflows, which represent the return on the investment made in the project. This is the project’s utmost importance. A meticulous and cautious approach is essential for estimating cash inflows, which are based on specific historical data. The benefits obtained by the investing entity depend upon the difference between the cash outflows both initial and subsequent outflows at different project stages and the estimated cash inflows likely to accrue throughout the project.

4) Non-Monetary View

In addition to the financial perspective of a project, it’s crucial to consider non-financial aspects, such as the company’s market goodwill and reputation. Neglecting these factors during project evaluation could result in inaccurate conclusions.

5) Ranking the Proposals

When faced with multiple investment options that all seem equally appealing, it becomes important to prioritize and rank them accordingly. Upon evaluation, we use a comprehensive cost-benefit analysis to rank the investment proposals based on their viability and merit. This enables the management to make suitable decisions without any hassle, especially in a situation of limited financial resources.

6) Risk and Uncertainty

Unpredictable future and inherent risk embedded therein suffer major challenges during the exercise of ‘Capital Budgeting’. Proper assessment of risks involved in a project and their effective mitigation should be an integral component of assessing the project’s profitability and viability. One practical approach is to assign probabilities to various expected net cash inflows.

Predicting probabilities is challenging due to numerous underlying factors such as general economic conditions, industry-specific economic trends, market competition, technological advancements, rapidly changing consumer preferences, workforce availability, and other resources.

This complexity makes it hard to anticipate the future. Hence, it’s important to thoroughly assess all aspects and implement necessary measures to address challenges encountered in the capital budgeting process for investment proposals.

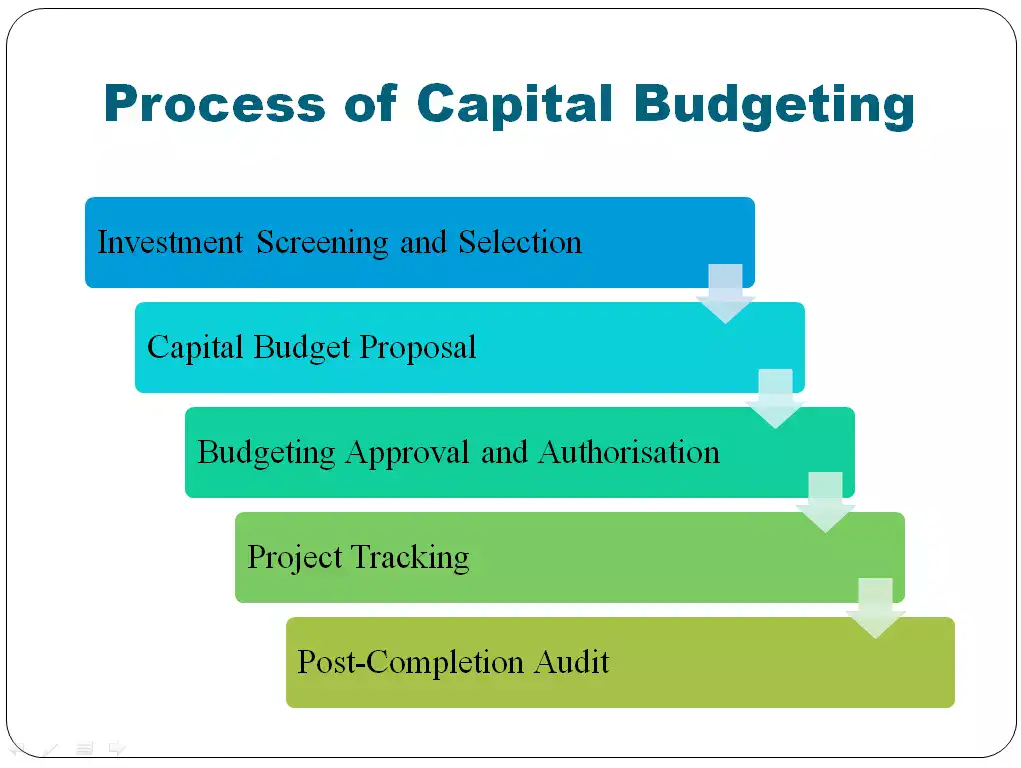

Process of Capital Budgeting

The process of capital budgeting includes five distinct stages, and we provide an outline of them below.

- Investment Screening and Selection

- Capital Budget Proposal

- Budgeting Approval and Authorisation

- Project Tracking

- Post-Completion Audit

Stage 1: Investment Screening and Selection

Various departments of the organisation, viz., Production, Marketing, R&D, etc., identify projects, which need to conform with the business policies. The screening and evaluation of these identified projects rely on specific criteria that measure their influence on the company’s future cash flow and overall value.

Stage 2: Capital Budget Proposal

After screening and evaluation, we subject the identified projects to the Capital Budgeting process. The list of suggested projects includes the estimated capital outlay (investment amount) and revenue generation for each project. After taking into account data from different departments like engineering, accounting, marketing, and finance, we arrive at the ultimate project selection.

Stage 3: Budgeting Approval and Authorisation

The capital budgeting process leads us to a final decision on various projects. Projects thus selected are authorised for further information gathering and analysis, and approval for the expenditures in respect to selected projects.

Authorisation and approval are done in a sequence in some organisations (after authorisation, some additional research is carried out before the approval), whereas, the projects are authorised and approved simultaneously in some other organisations.

The above exercise of authorisation and approval is undertaken in cases where huge expenditures are projected; smaller expenditures are left for the decision of management.

Stage 4: Project Tracking

The initiation of work on a project follows its approval. The work and associated expenditures are closely monitored through regular reports provided to management. “Project tracking” is the usual way to describe the process of monitoring a project.

This is a link between the ‘Operating Management’ and ‘Decision Makers’ of the organisation. Project Tracking is of paramount importance, as it can immediately identify any problem associated with the project such as cost overruns. This allows decision-makers to promptly implement corrective measures to resolve these issues.

Stage 5: Post-Completion Audit

Some of the projects may be subjected to an audit (Post Completion Audit), after the approval of that project, i.e., after completion of a few years, during which the project is reviewed to take a view whether or not they need to be continued. However, such audits are performed only on a few selected projects. Through the completion audit, the management of the company can ascertain how well the cash flow realised corresponds with the projected cash flow.

FAQ

1. What are the various features of capital budgeting?

You May Also Like:-